inherited annuity tax calculator

You could opt to take any money remaining in an inherited annuity in one lump sum. June 3 2019 1103 AM.

Annuity Interest Rate Calculator Find Your Apr New York Life

Ad Learn More about How Annuities Work from Fidelity.

. Discover The Answers You Need Here. 2 1936 and the lump-sum distribution is from a qualified retirement annuity you may be able to elect up to five optional methods of. Nheritance and Estate Planning With Simple Pricing.

If an annuity contract has a death-benefit provision the owner can designate a beneficiary to inherit the remaining annuity. Death Benefits Payout Options. These payments are not tax-free however.

Use this annuity tax calculator to compare the tax advantages of saving in an annuity versus a taxable account. Payout Options Tax Consequences 2022 The original annuity contract holder must include a death benefit provision and name a beneficiary. Qualified annuities are funded with pre-tax dollars while non-qualified annuities are funded with after-tax dollars.

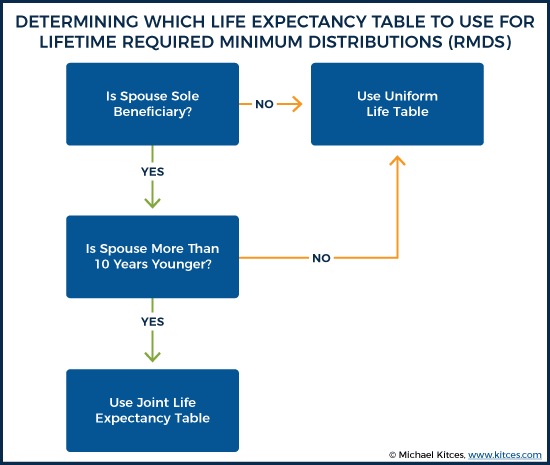

RMD applies to a traditional IRA or a qualified retirement plan. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. Like any other type of income inherited annuities are taxable.

Ad Understand The Inheritance Process. Dont let the banks or lawyers Delay Your Inheritance - Get an Inheritance Advance today. John reported 0 in income on his 2020 return and carried the 15000 excess.

Tax Rules for Inherited Annuities. Annual payments of 4000 10 of your original investment is non-taxable. And you have the same amount of.

The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. Keep in mind this provision only applies to spouseschildren named as. The timing of the tax event depends on the payout structure and your.

The annuities would not have an RMD if your father purchased them. John repaid 45000 on November 10 2020. Ad Learn More about How Annuities Work from Fidelity.

1 Best answer. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount.

A tax-qualified annuity is one. He makes no other repayments during the allowable 3-year period. An inherited IRA is an account opened to distribute the assets of a deceased owner of an individual retirement account IRA or employer-sponsored plan to the beneficiary or.

This difference affects many aspects of how the two types of. Only a spouse can inherit an annuity and benefit from the options the late. Youd have to pay any taxes due on the benefits at the time you receive them.

Because of this only 148 of your 565 monthly payout will be subject to ordinary. An annuity is a financial product that can be passed down from one generation to another. If the annuity is an immediate annuity the entire payout is.

When inheriting an annuity from a parent you will have to pay taxes on payments as ordinary income. You have an annuity purchased for 40000 with after-tax money. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Ad Search For Answers From Across The Web With Topsearchco. Build Your Future With A Firm That Has 85 Years Of Investing Experience. When you inherit an annuity you assume what is referred to as the owners basis which means you own the amount of already-taxed money in the account.

You live longer than 10 years. Calculate the required minimum distribution from an inherited IRA. If you inherit an annuity you may have to pay taxes on your money.

Dear Allen If you were born before Jan. Its basically returning to you all of the money you paid them after tax plus interest. Tax Rules for Inheriting an Annuity.

My spouse inherited a lump sum payout of 134000 from her fathers IRA. The earnings are taxable over the life of the payments.

Annuity Taxation How Various Annuities Are Taxed

![]()

Inherited Annuity Tax Guide For Beneficiaries

Inherited Annuity Commonly Asked Questions

Annuity Exclusion Ratio What It Is And How It Works

Non Deductible Iras How To Keep Down Taxes On Withdrawals Money

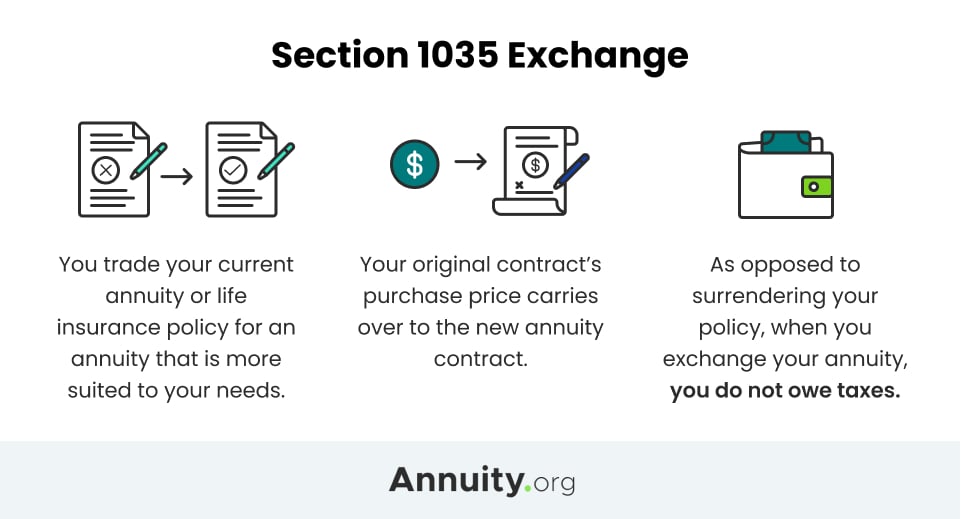

1035 Annuity Exchange Swapping One Annuity For Another

Distribution Options For Inherited Non Qualified Annuities Bsmg Brokers Service Marketing Group

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Know Your Inherited Annuity Options To Discover The Tax Savings

4 Questions To Ask Before Buying An Annuity Charles Schwab

What Is The Best Thing To Do With An Inherited Annuity Due

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

Taxes And Your Inherited Annuity Annuity Fyi

Inherited Annuity What Are Your Options

What Is The Tax Rate On An Inherited Annuity Smartasset

I Inherited Annuities From My Dad How Can I Avoid Being Double Taxed Marketwatch

Annuity Interest Rate Calculator Find Your Apr New York Life

Do I Pay Taxes On All Of An Inherited Annuity Or Just The Gain